Cash Account

The Cash Account feature in Pro Stock Tracker allows you to track and manage the cash flow within your investment portfolio. It offers a detailed record of all cash movements within your portfolio, including deposits, withdrawals, dividends, trades, and other cash-related activities.

Understanding the Cash Account

Tabs

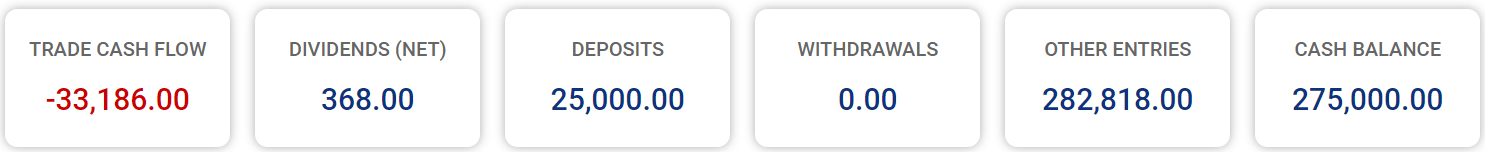

Six tabs at the top summarize key value metrics of the cash account as of the selected date:

- Trade cash flow: The net difference between cash inflow and cash outflow, representing the overall change in cash position due to trading activities.

- Dividends (net): The total net dividend received. This figure includes reinvested dividends.

- Deposits: The total amount of money deposited into the portfolio cash account.

- Withdrawals: The total amount of money withdrawn from the portfolio cash account.

- Other entries: This figure summarizes all other cash movement entries such as balance adjustments, interest payments, fee reimbursements, fees, and interest charges.

- Cash balance: It is the sum of all previous tabs and it matches the cash available on the account.

Filters and options

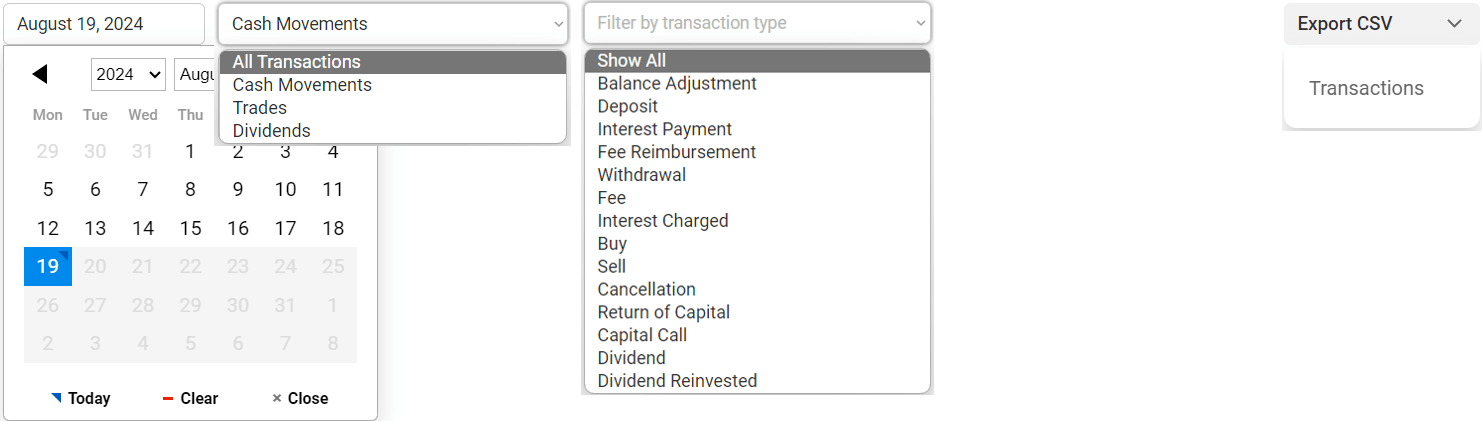

Customize your report and export data using the available options:

- Date: Select a specific date to view all transactions that occurred on or before that date. The summary tabs at the top of the page will reflect the cash account metrics as of the selected date.

- Transaction category: Use the dropdown menu to filter transactions. You can view all portfolio transactions up to the selected date, or focus on specific categories like cash movements, trades, or dividends. The default view shows "Cash Movements".

- Type: Refine your view further by selecting a specific transaction type, such as deposit, withdrawal, buy, or sell.

- Export: Download the report data as a CSV file.

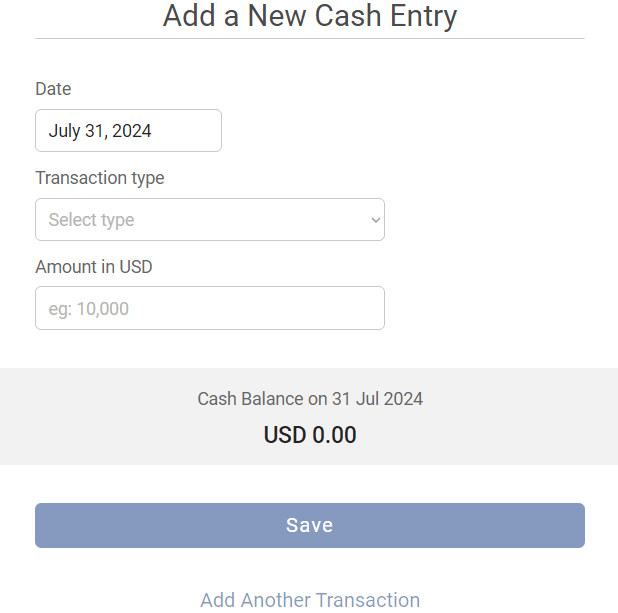

Add Cash Entry

Click this button to open a popup where you can add a new cash entry. Simply select the date of the transaction, the transaction type, and the amount expressed in the portfolio currency. Choose from 7 different types:

- Balance adjustment: Use this option to reconcile your account balance, particularly when starting with an existing cash balance or when your transaction history is incomplete. It allows you to adjust the balance without needing to record each historical transaction individually.

- Deposit: An addition of funds to your cash account.

- Interest payment: Income earned on your cash balance.

- Fee reimbursement: A refund of fees previously charged.

- Withdrawal: A removal of funds from your cash account.

- Fee: This represents other charges incurred for services or transactions, excluding trading fees associated with buying or selling holdings, which are already incorporated into their respective transactions.

- Interest charged: Interest expense incurred on borrowed funds or margin accounts.

When using the "Balance Adjustment" option, simply enter your desired cash balance as of the chosen date in the portfolio's currency. The app will automatically calculate and create an entry to adjust your cash account accordingly.

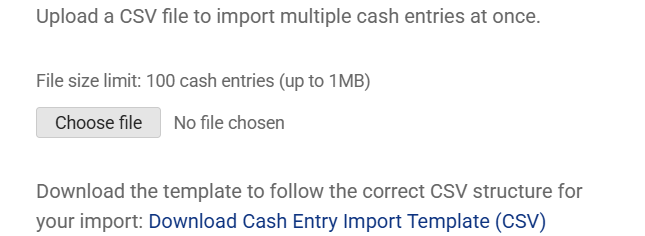

Bulk Cash Import

The Bulk Cash Import feature allows you to upload multiple cash transactions at once, making it easier to manage large sets of cash movements compared to entering them individually.

Start the Import Process

To begin, click the Bulk Cash Import button to launch the guided import flow.

Step 1: Select Your File

Upload a CSV file containing your cash transactions. This can be a file exported from your broker or one you've created manually.

Your file must meet the following requirements:

- Maximum file size: 100 entries (up to 1MB).

- Decimal format: Use a dot (

.) as the decimal separator. - No thousand separators: Do not use commas or other formatting for thousands (e.g., use

1000not1,000). - Structure: The file should only contain the cash transaction table. No extra text, headers, or formatting outside the data table.

- File format: Save your file as CSV UTF-8 (Comma delimited).

To avoid common import errors, please ensure your file also follows these additional guidelines:

- Required fields: Each row must include a date, entry type, and amount. No empty cells are allowed.

- Date format: Use either MM/DD/YYYY (US) or DD/MM/YYYY (International), with

/as the separator. Time can optionally follow the date, separated by a space. Use 4-digit years only.- ✅ 12/31/2024 (US) - Valid example

- ✅ 31/12/2024 (Intl) - Valid example

- ❌ 2024/12/31 - Invalid example

- ❌ 31-12-2024 - Invalid example

- ❌ 31 Dec 2024 - Invalid example

- Cash entry types: Entry types must match exactly one of the supported values:

Deposit,Withdrawal,Interest Payment,Fee Reimbursement,Fee,Interest Charged. - Amount field: Only use plain numbers without any symbols or formatting.

- ✅ 1000 - Valid example

- ❌ $1000 | ❌ 1,000 | ❌ One thousand - Invalid examples

To help minimize formatting issues, we recommend downloading the sample file by clicking Download Cash Entry Import Template (CSV) during the import process.

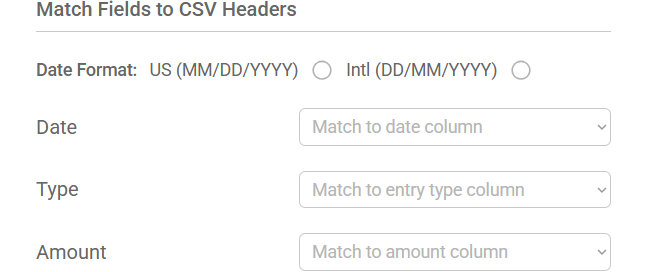

Step 2: Map Columns

After uploading your file, configure your import settings to ensure accurate data mapping:

- Date Format: Choose whether your file uses the US format (MM/DD/YYYY) or the international format (DD/MM/YYYY).

- Column Mapping: For each required field on the left, use the dropdown menu to select the corresponding column from your file:

- Date: When the transaction occurred.

- Type: Type of cash entry.

- Amount: Amount of the cash entry, expressed in your portfolio currency.

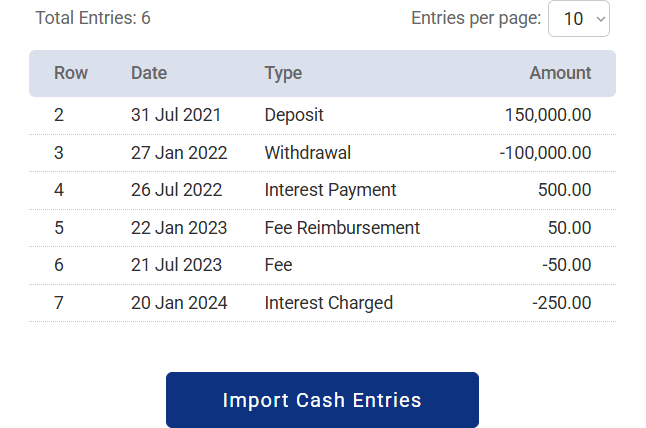

Step 3: Review and Import

Before finalizing the import, review the converted data in the preview table:

- Errors will be highlighted in red, with detailed explanations shown below the table.

- Use the Show Errors Only option to filter the table and focus on any issues.

- If everything looks correct, click Import Cash Entries to complete the process.

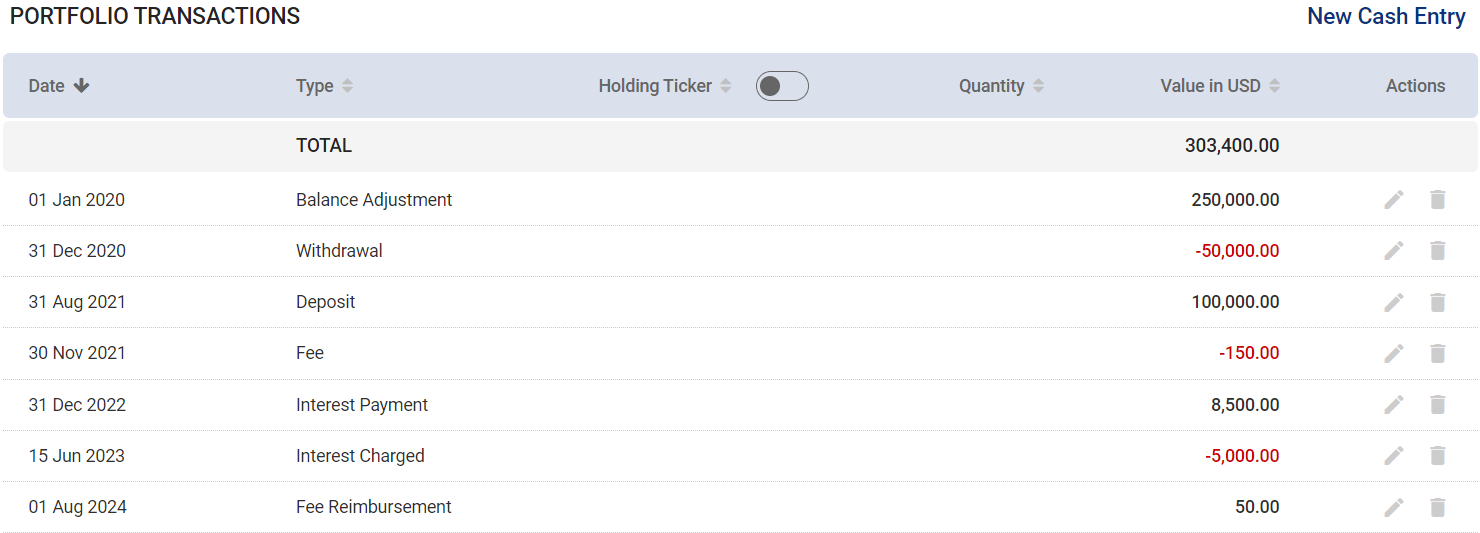

Table

The detailed table displays:

- Date: The date the transaction occurred. If you see "(ex-date)" next to a dividend date, it means the payment date is missing from the dividend, and the app has used the ex-dividend date instead. You can easily add the payment date by editing the relevant dividend in the holding's page.

- Type: This column shows the type of transaction. For dividends that were reinvested, the word "(reinvested)" will appear next to "Dividend".

- Holding name: For transactions linked to a specific holding, this column displays the holding's ticker symbol and name. Click on the holding name to access its individual page, where you can manage related transactions.

- Quantity: This column shows the number of shares or units involved in transactions where quantities are applicable, such as buy and sell trades.

- Value: The value of each transaction expressed in the portfolio currency.

- Actions: You can edit or delete cash movement transactions (like deposits and withdrawals) using the pencil and bin icons, respectively. To modify or delete other transaction types (such as buy, sell, dividends) navigate to the relevant holding's page.

You can also sort the table by clicking on any column header.

Additional notes

In the Cash Account, positive values represent cash inflows (e.g., deposits, proceeds from selling holdings), while negative values signify cash outflows (e.g., withdrawals, purchases of holdings). This convention is the opposite of what you'll see in the Trade Report, where buy transactions are positive and sell transactions are negative.

Any changes made to trade or dividend transactions will automatically update the corresponding entries in the Cash Account. Since these transactions are linked, you cannot edit or delete them directly from the Cash Account; you must do so from the relevant holding's page.

How to use the Cash Account

To view and manage your cash account, follow these steps:

- Navigate to the Cash Account page.

- Review the tabs for an overview of your cash account metrics.

- Use the filters to select your desired date, transaction category, and type.

- Analyze the table to see details of your cash transactions.

- Click New Cash Entry to add transactions.

- Review and manage transactions in the table.

- (Optional) Click the Export button to download the cash transaction data as a CSV file.

Note: The displayed data, including the summary tabs and transaction table, reflects the information as of the selected date.